Quality of Earnings Analysis

for Small Business Acquisitions

We help business buyers uncover hidden risks and verify seller earnings before closing. Full-scope QoE reports delivered by a CFA charterholder with 14 years of M&A experience. Purpose-built for SBA deals under $10M.

Trusted by Small Business Buyers

"Matt and Provafi were instrumental in providing an accurate, timely (hours and days, not weeks) Quality of Earnings Report. The depth, thoroughness, and insightfulness were unexpected, especially from an AI-driven resource. I will note that I received the QoE for free as part of beta testing, but absolutely believe this is comparable in quality to traditional QoE reports. I will be using Provafi in the future."

Brent Jackson

Principal, Jackson Clear Capital LLC

"Matt and Provafi provided exceptional diligence support—thorough, fast, and highly data-driven. The analysis gave us clear visibility into earnings quality and helped us move confidently toward closing."

Founder & Managing Director

Privately Held Holding Company

How It Works

We run the full process for you and deliver clear, precise diligence analysis so you avoid bad deals or confidently acquire your target.

Book an intro call

Confirm fit, scope, and timing. Align on data needs and lender expectations.

Upload data securely

Provide financials, bank statements, tax returns, and supporting docs via the portal.

We process the data

We clean, normalize, and map transactions—no self-serve configuration.

Analyze & identify red flags

CFA-reviewed analysis of earnings quality, normalization adjustments, trends, working capital, and red flags.

Review call

30-minute walkthrough of findings, Q&A on adjustments, and IC-ready takeaways for lenders and investors.

What You Get Access To

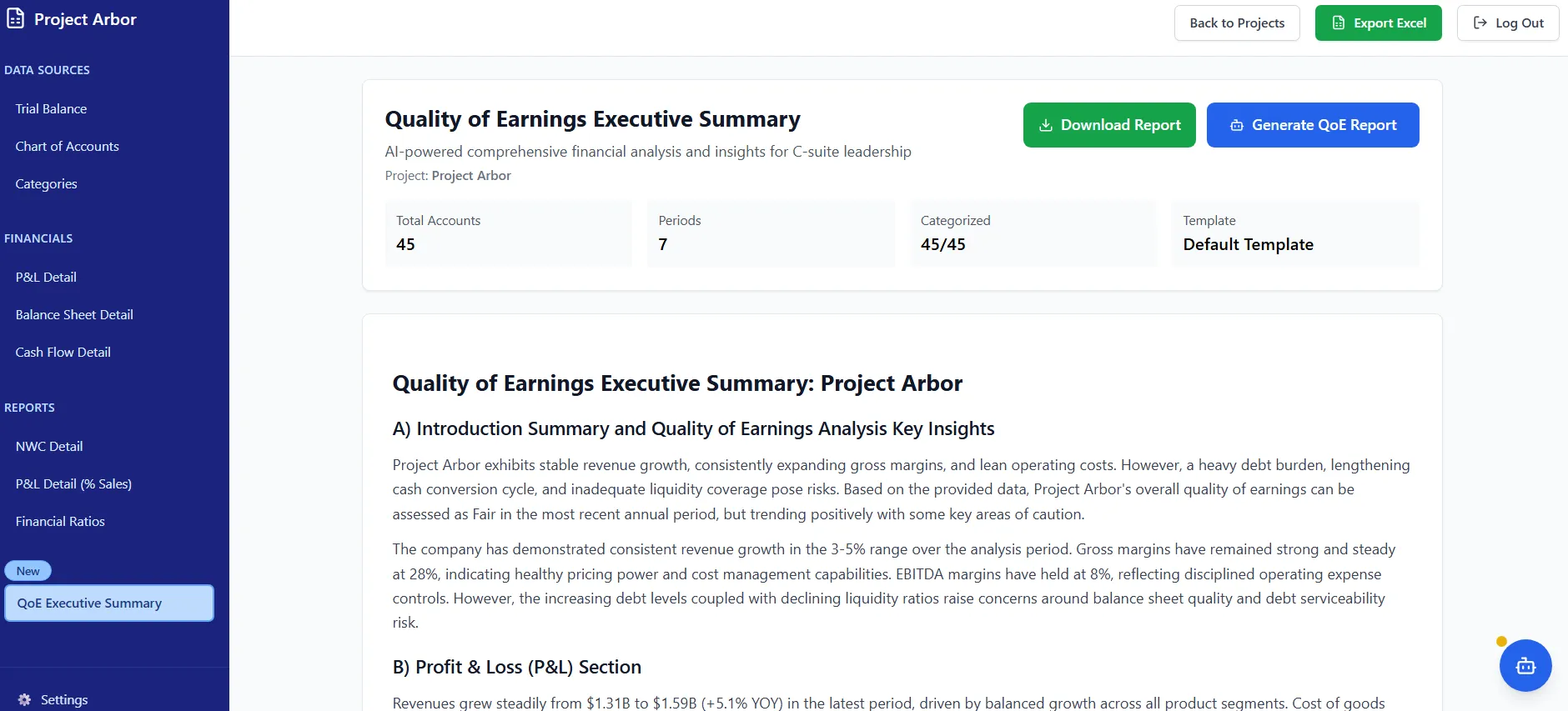

Every Provafi engagement includes portal access. After we deliver your QoE report, you can review normalized financials, explore trends, download Excel exports, and ask follow-up questions through our AI chat—all based on your completed analysis.

Executive summary dashboard with key findings and normalized EBITDA.

Detailed financials with trend analysis and comparisons.

Ask questions about specific line items or adjustments through AI chat.

Download Excel databook and supporting schedules for your files.

Why Provafi for Your QoE?

Professional QoE analysis at a fraction of traditional costs

2-Week Delivery vs 4–6 Weeks

Get your complete Provafi QoE in 2 weeks—normalized EBITDA, red flags, and IC-ready deliverables without the month-long wait of traditional firms.

$5K Fixed Price vs $25K+ Traditional Firms

Professional, CFA-reviewed QoE analysis for a fraction of traditional costs. No hourly billing, no scope creep, no surprises—just fixed-scope work you can budget for.

CFA-Reviewed + Software-Powered

Human judgment on earnings quality, normalization adjustments, and red flags—accelerated by software for data processing and consistency.

Complete Deliverable Package

IC-ready Word memo, PowerPoint executive summary, Excel databook, and portal access for ongoing analysis—ready for lenders and investors.

Purpose-Built for Sub-$10M Deals

Ideal for SBA acquisitions, searcher deals, and independent sponsor transactions where $25K full QoE is overkill but DIY isn't credible enough.

Ideal For

SBA buyers, searchers, independent sponsors, and family offices who need professional QoE analysis on sub-$10M acquisitions

SBA Buyers & Searchers

Evaluate target financials before committing to a $25K full QoE. Get normalized EBITDA, red flags, and IC-ready analysis in 2 weeks to support lender discussions and investment decisions.

Independent Sponsors & Family Offices

Screen platform and add-on opportunities with professional QoE analysis. Fixed-scope deliverable you can present to LPs or investment committees without the cost and timeline of traditional firms.

Ready to Get Started?

Book a 15-minute intro call to confirm fit and discuss your timeline.